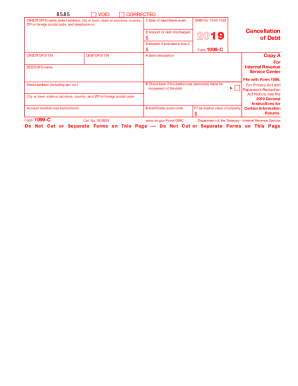

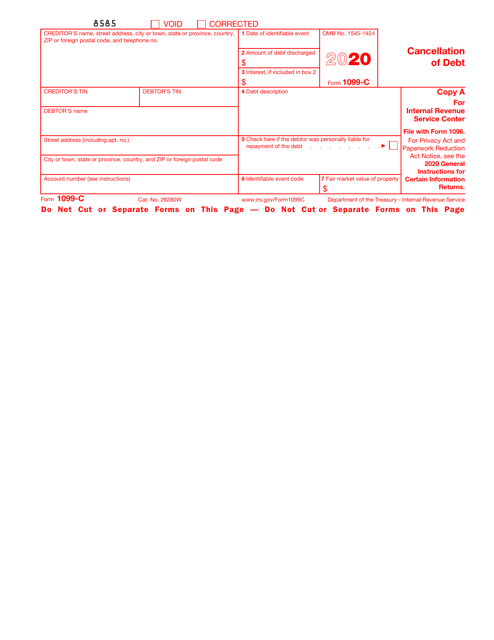

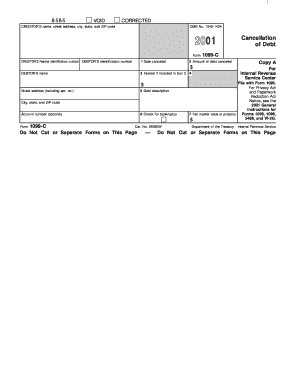

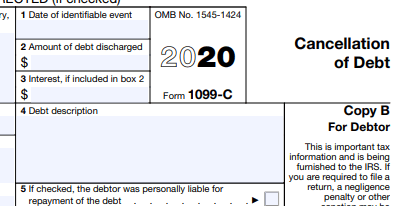

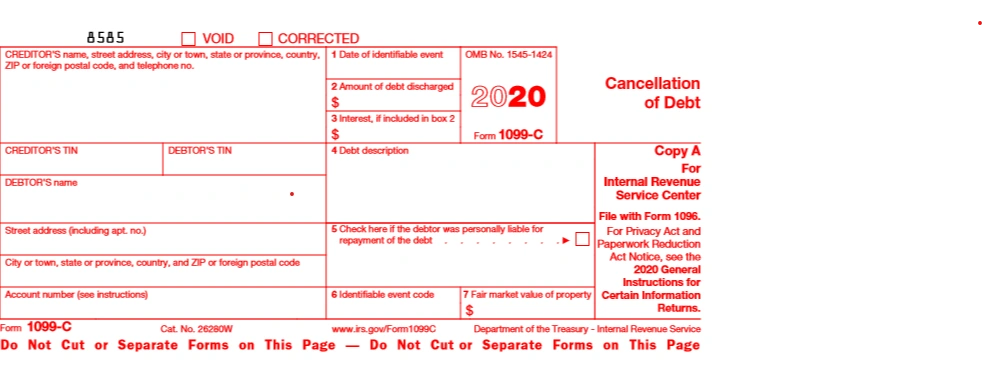

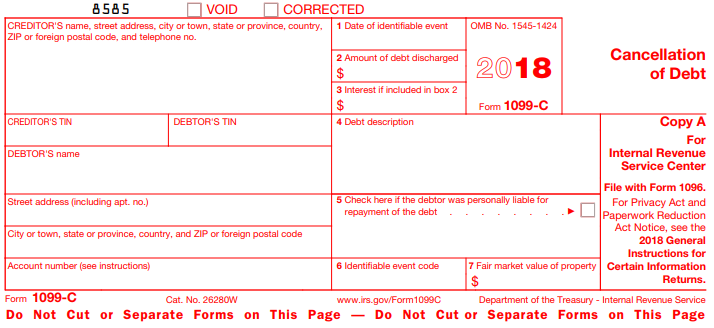

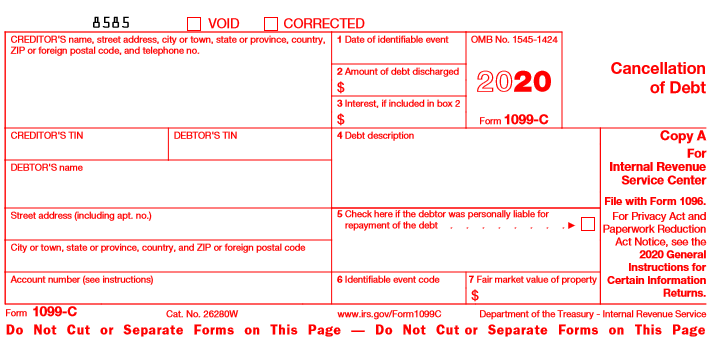

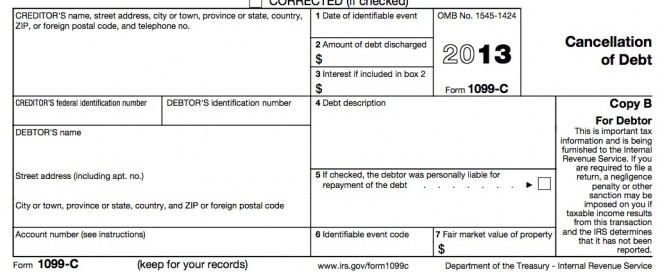

Jun 06, 19 · You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt For more information, please see When to Use Tax Form 1099C for Cancellation of Debt But even if you receive a Form 1099C from a lender, you still may be able to avoid taxation on the forgiveness of a debtJun 01, 19 · 1099C for deceased spouse Assuming the Form 1099C's tax year states 16 and if she had an estate established, then the estate would be responsible for paying the tax on the income In the absence of an estate, then you have nothing to reportA 1099C is a form used to report various types of income

Horizon Software Firetax

How to get a 1099 c form

How to get a 1099 c form-Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAPThere was no estate when he passed and things have changed the past years that this will have an ill effect on my side

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

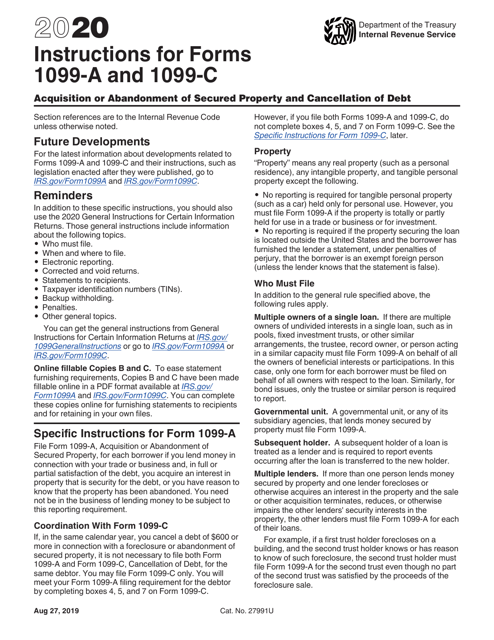

Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 18 Inst 1099A and 1099CEfile Form 1099C Online to report the Cancellation of debt Efile as low as $050/Form IRS Approved We mail the 1099C copies to your debtorMar 13, 19 · To file an amended return, start with IRS form 1040X (link opens PDF) Adjust your taxable income to include the amount of forgiven debt, and explain in

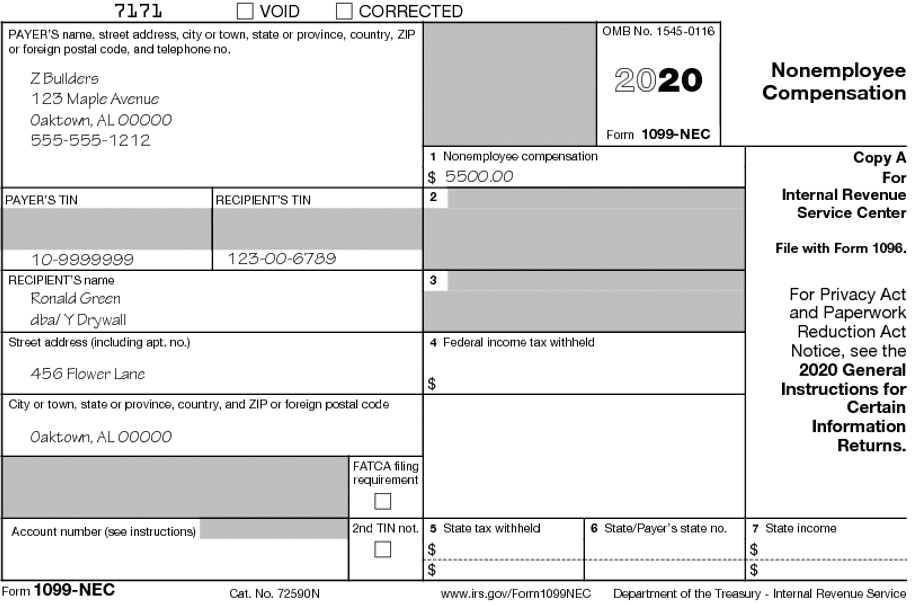

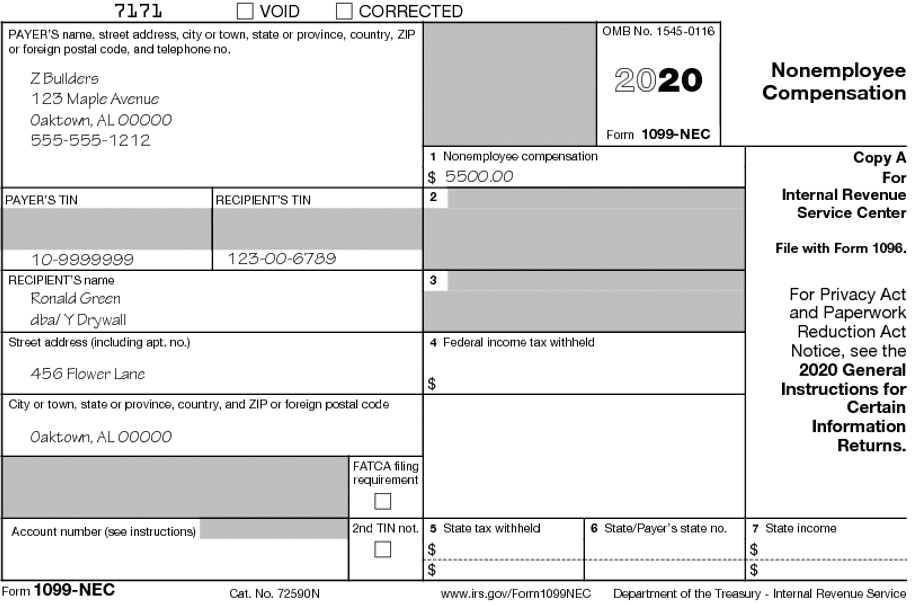

Form 1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue ServiceFile 1099C Online with Tax1099 for easy and secure eFile 1099C form How to file 1099C instructions & due date IRS authorized eFile service provider for form 1099CSelect the type of canceled debt (main home or other) and then select Continue;

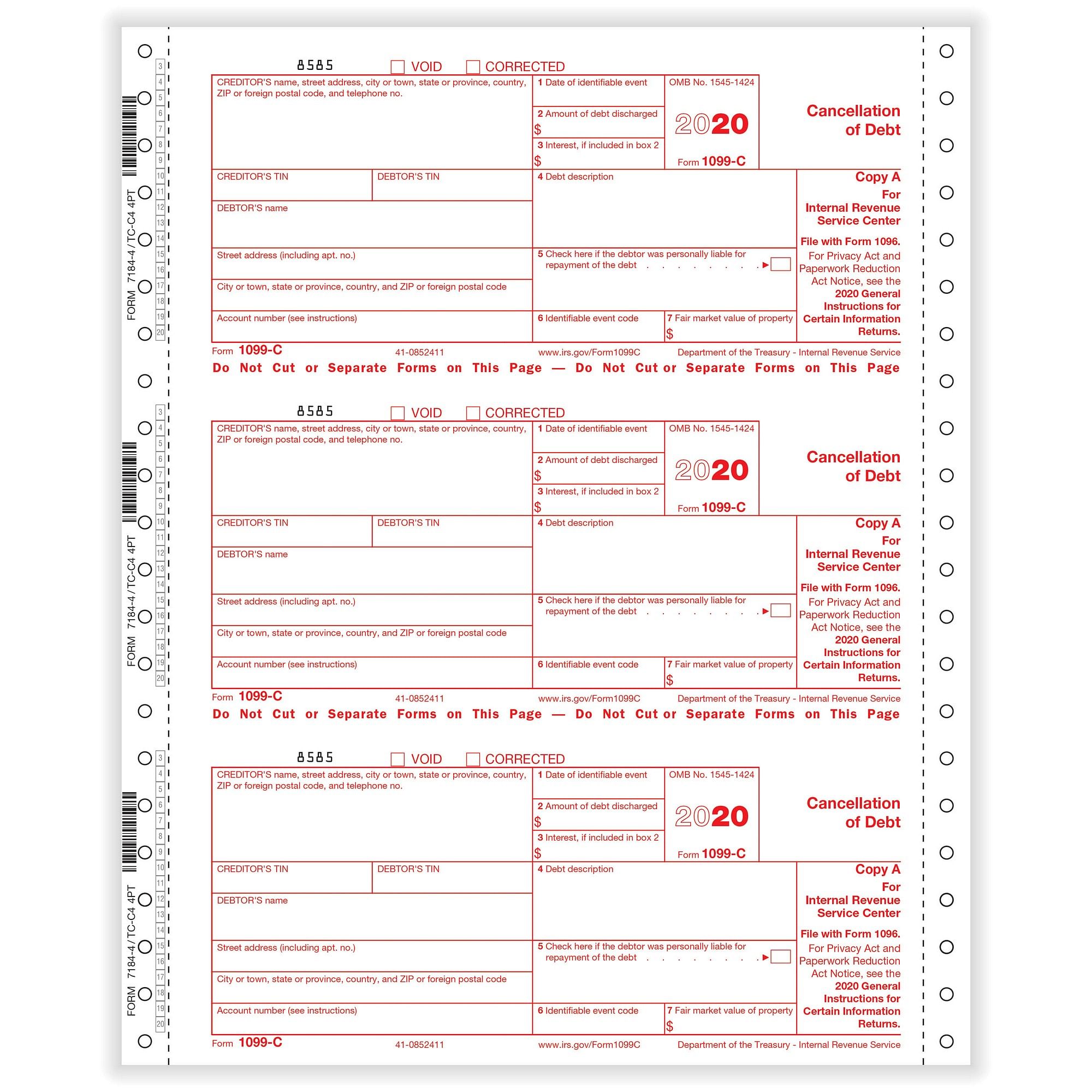

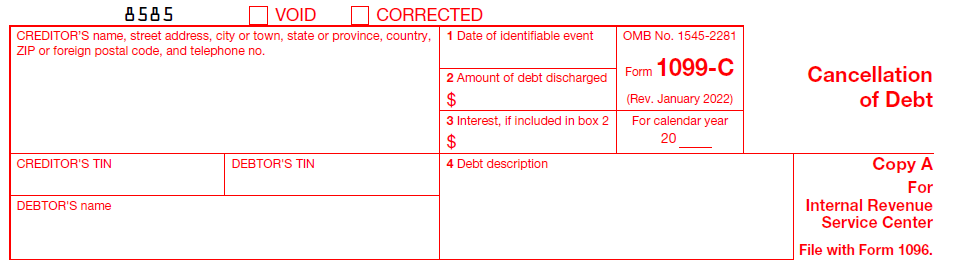

Form 1098C as a PDF attachment if your software program permits) If you do not attach Copy B of Form 1098C to your return (or to Form 8453) when required, the IRS will disallow your deduction Generally, you must also attach Form , Noncash Charitable Contributions, if the amount you deduct for all noncash gifts is more than $500You may file Form 1099C only You will meet your Form 1099A filing requirement for the debtor by completing boxes 4, 5, and 7 on Form 1099C However, if you file both Forms 1099A and 1099C, do not complete boxes 4, 5, and 7 on Form 1099C See the Specific Instructions for FormComplete IRS 1099C 21 online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documents

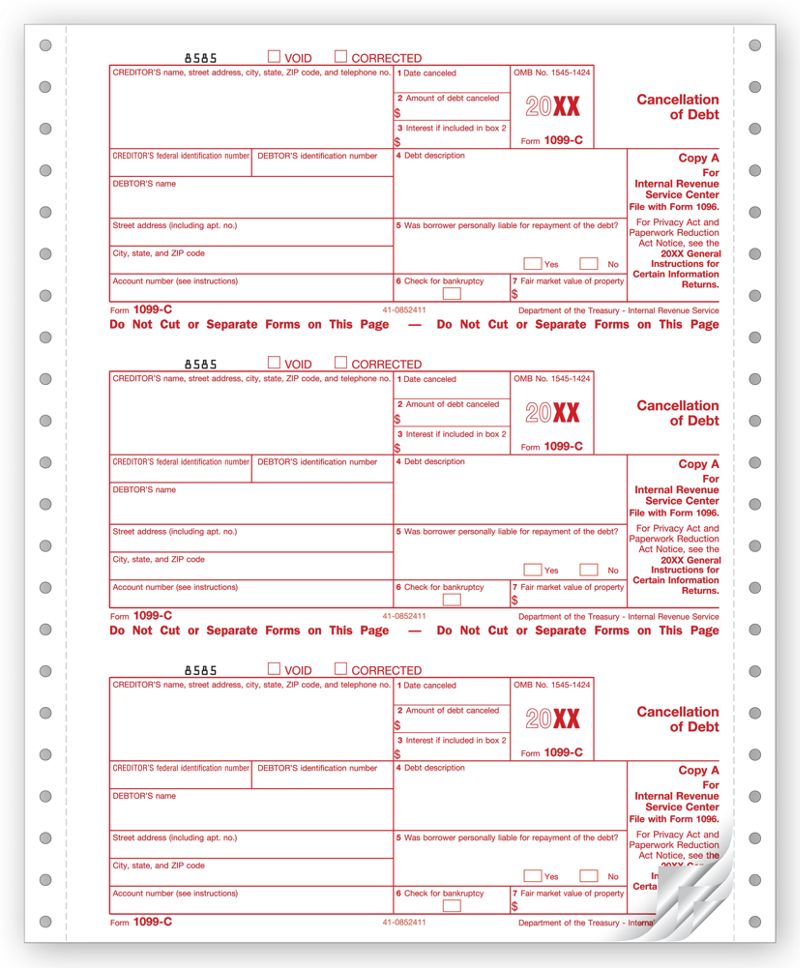

1099 C Federal Copy A For 50 Recipients Forms Recordkeeping Money Handling Human Resources Forms

Help I Just Got A 1099 C But I Filed My Taxes Already

Form 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due DateDo not file Form 1099C when fraudulent debt is canceled due to identity theft Form 1099C is to be used only for cancellations of debts for which the debtor actually incurred the underlying debt CAUTION!2Instructions for Forms 1099A and 1099C ()If a Federal Government agency, financial institution, or credit union cancels or forgives a debt you owe of $600 or more, you will receive a Form 1099C Cancellation of DebtThe amount of the canceled debt is shown in Box 2

Irs Courseware Link Learn Taxes

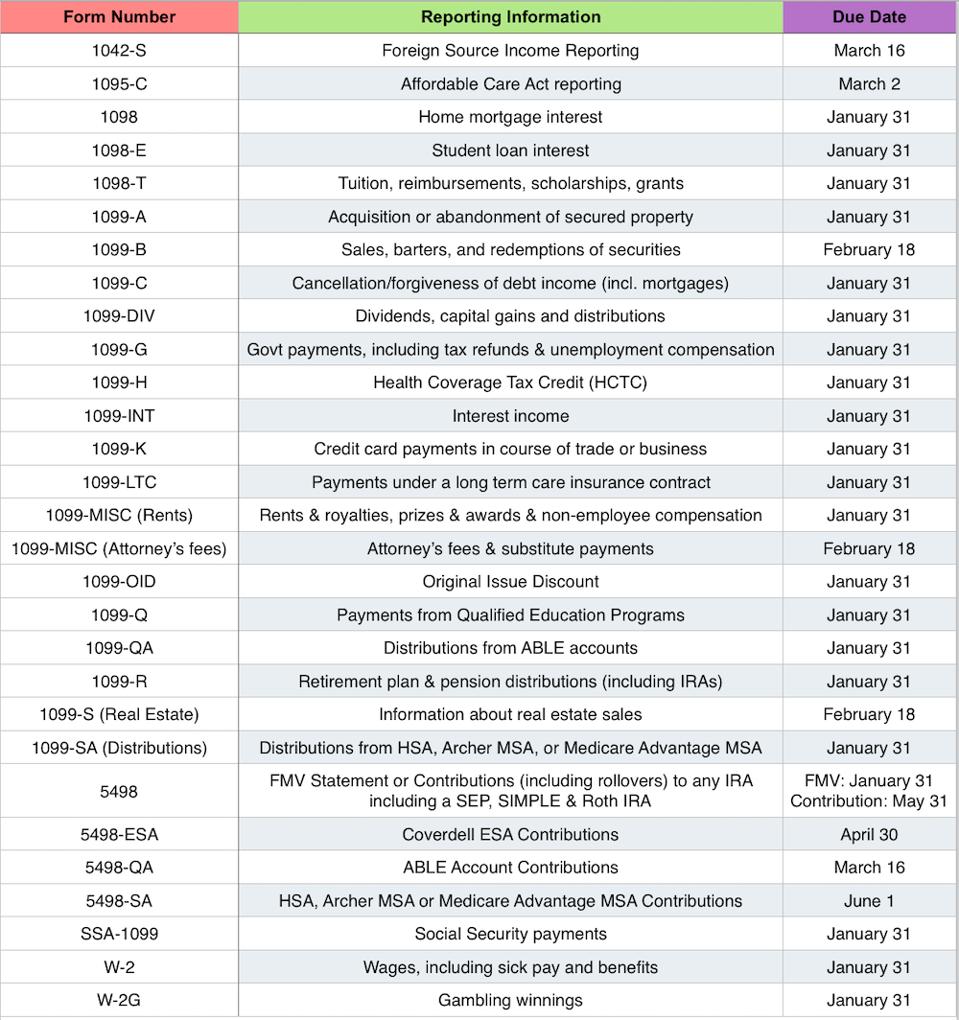

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

Jan 30, · This month, , I received a 1099 C for the cancellation of debt, in his name only I am in a community property state, am I responsible to file this for ?Feb 09, 21 · Form 1099C is a tax form required by the IRS in certain situations where your debts have been forgiven or canceled The IRS requires a 1099C form for certain acts of debt forgiveness because it considers that forgiven debt as a form of incomeClick Add Form 1099C to create a new copy of the form or click Edit to review a form already created The program will proceed with the interview questions for you to enter or review the appropriate information Note On the screen titled Cancellation of Debt Form 1099C Information, enter the information from Form 1099A as follows Enter

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

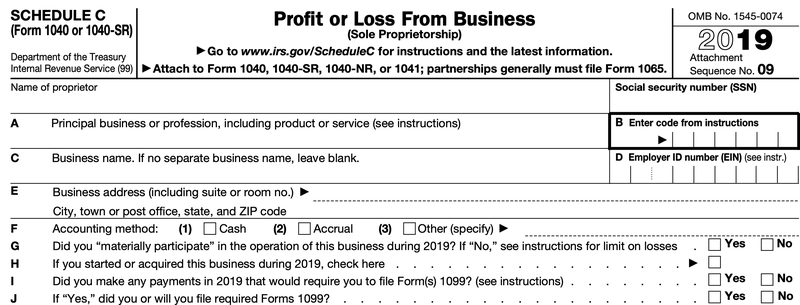

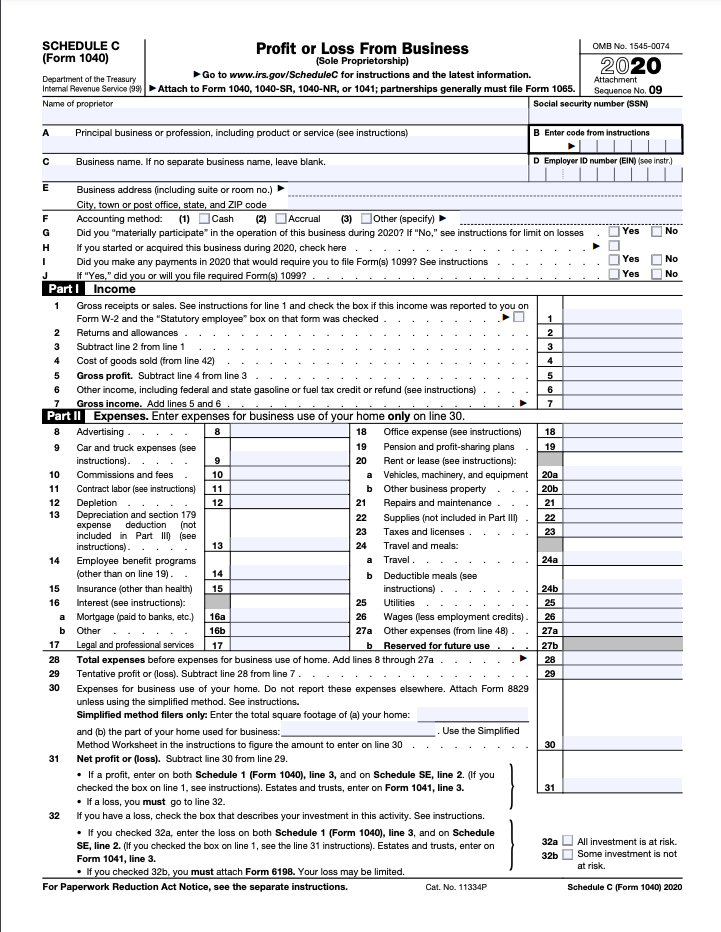

Step By Step Instructions To Fill Out Schedule C For

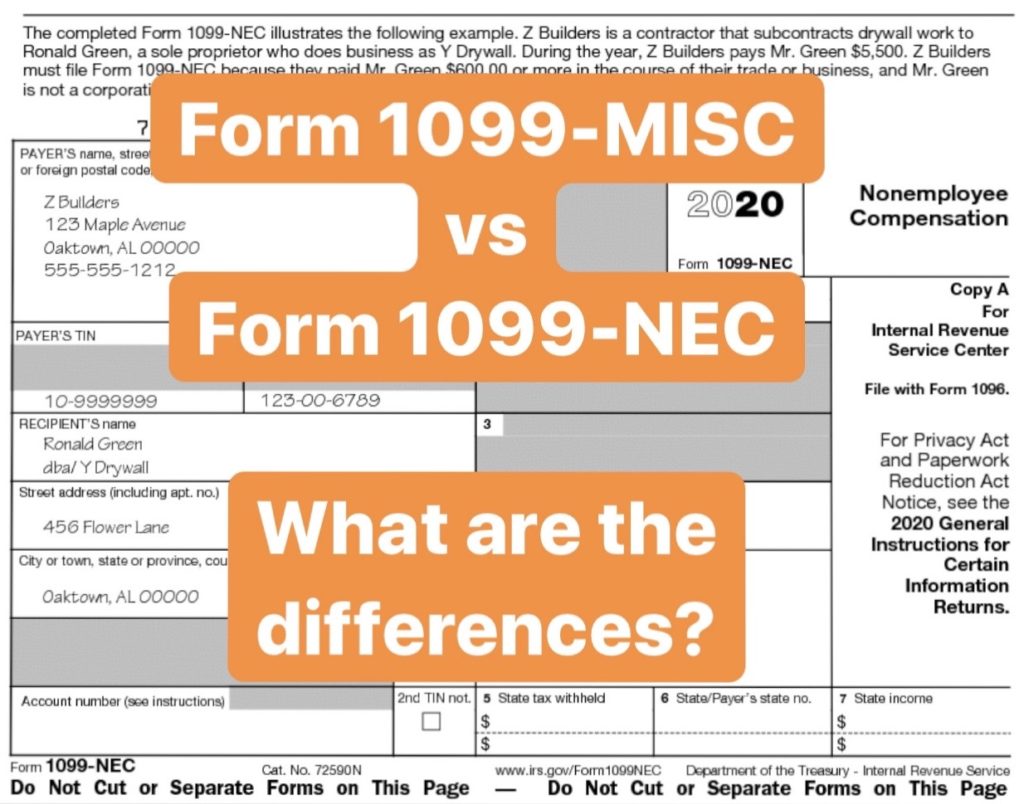

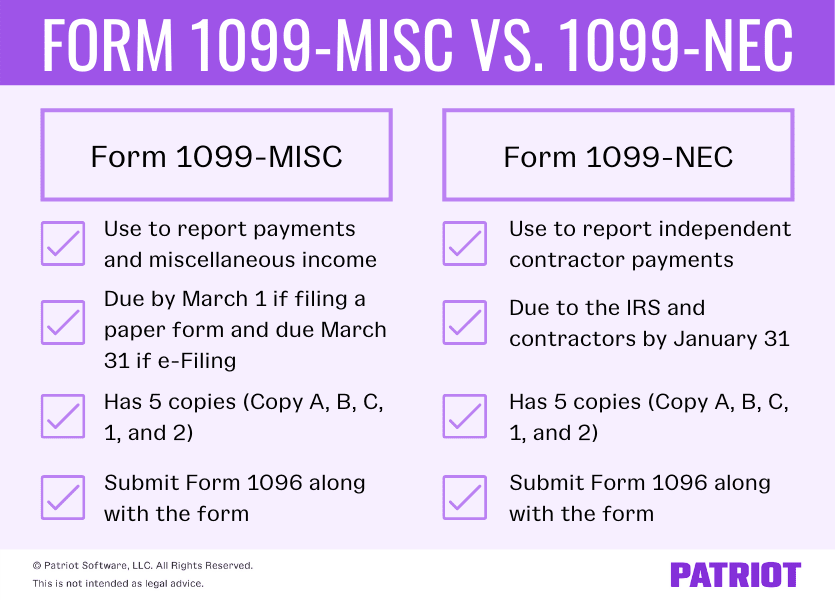

Dec 19, · The 1099 form is used to report miscellaneous income to the Internal Revenue Service, such as nonemployee compensation, rents, royalties, prizes and awards, payments to an attorney, certain medical and health care payments, and more The IRS has introduced a new Form 1099 for , Form 1099NECMay 06, 21 · IRS Form 1099C is an informational statement that reports the amount of and details about a debt that was canceled You can expect to receive the form from any lender that has forgiven a balance you owe, no longer holding you liable for repaying itOffer valid for returns filed 5/1/ 5/31/ If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Form 1099 Misc Vs Form 1099 Nec How Are They Different

May 09, 21 · "Topic No 432 Form 1099A (Acquisition or Abandonment of Secured Property) and Form 1099C (Cancellation of Debt)" Accessed Aug 17, Accessed Aug 17, IRSIn most situations, if you receive a Form 1099C from a lender after negotiating a debt cancellation with them, you'll have to report the amount on that form to the Internal Revenue Service as taxable income Certain exceptions do apply The federal tax filing deadline for individuals has been extended to May 17, 21Mar 24, 21 · Enter the "Cancelation of debt (1099C)" code 6 under the Cancelation of Debt subsection (this amount is typically found on Form 1099C, box 2 To verify, see the computation below) Figuring the amount to use for Cancelation of Debt when viewing the 1099C Enter the total amount of the debt immediately prior to the foreclosure

What Is The Account Number On A 1099 Misc Form Workful

What Is Form 1099 Nec For Nonemployee Compensation

Dec 12, 19 · If you don't report a received Form 1099C, you can incur IRS penalties and interest, or the IRS might choose to audit you You can report a missed 1099C receipt even after you filed your return with a Form 1040X, Amended US Individual Tax Return You'll pay a 05 percent late fee for each month the tax remains unpaidNov 26, · Form 1099C—Cancellation of Debt is the tax form that reports canceled debt which is taxable in most cases This includes the debt that has been canceled, discharged, or forgiven The IRS sees pretty much any debt that has beenWithin a 1040 return, there is not a specific IRS 1099C input form to fill in Instead, depending how the cancellation of debt is to be treated, there are a few options you have in order to get this to flow correctly to your return Method 1 To have the amounts from the IRS 1099C flow to the 1040 line 21 as other income

:max_bytes(150000):strip_icc()/Screenshot39-fb0ecf0139834b37943efafda8ef09b4.png)

Irs Form 1099 C What Is It

Form 1099 Misc To Report Miscellaneous Income

May 25, 19 · If your debt is canceled or forgiven, you'll receive Form 1099C (Cancelation of Debt) Note If you received a 1099C for your main home and another 1099C for something else (like a credit card, car loan, or second mortgage) you won't be able to use TurboTax, as we don't support this To enter your 1099C Open or continue your return, if it isn't already openApr 08, · What to know about Form 1099C and cancellation of debt If you've received at least $600 in forgiveness for your student loans , you'll be sent a Form 1099C by your creditor The student loan forgiveness form will include the following informationJun 06, 19 · I'm doing my 19 taxes not I was able to select the Jump to link to download the 1099C I answered the the following questions On the Tell us about your canceled debt screen, select Yes;

Irs 1099 C Form Pdffiller

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Feb 12, 21 · Note that if the foreclosure includes a cancellation of debt, you will also receive Form 1099C All pages of Form 1099A are available on the IRS website Here's a quick rundown of FormIf a Form 1099C Cancellation of Debt for canceled debt is issued to an S Corporation, the income inclusion (or exclusion) is applied at the corporate level If applicable, the corporation would then file Form 9 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 10 Basis Adjustment) with their tax return to report any tax attribute reductionsDec 30, · Losing your 1099C Form You can simply contact your creditor and request another copy of your 1099C form Receiving A 1099C Form For An Old Debt Note that 1099C forms don't fall under the statute of limitations

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/paying-medical-debt-with-credit-card-999e507c2a4f4580a71db69b6269377c.jpg)

Irs Form 1099 C What Is It

What Are Irs 1099 Forms

Apr 07, · Not all debts that are canceled require a 1099C They also don't all impact your taxes If you had any debts canceled or expect to receive a 1099C, you may want to work with a professional tax service to file your taxes What Is a 1099C Cancellation of Debt?To enter or review the information from Form 1099C Cancellation of Debt into the TaxAct ® program From within your TaxAct return (Online or Desktop), click FederalOn smaller devices, click in the upper lefthand corner, then click Federal;Aug , 19 · I'm administrator for the estate of a taxpayer who died in May 19 I just got word that a creditor will cancel an outstanding debt and issue an IRS Form 1099C later this year Question is, will this be taxable income for the decedent or for

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

Cancellation Of Debt Form 1099 C What Is It Do You Need It

However, it did not take me to where I need to enter the information from the 1099CDec 01, · Nicole Dieker 12/1/ If you have a 1099C form but did not include the forgiven debt as taxable income, you can file an amendment to your tax return Use Form 1040X,About Form 1099C, Cancellation of Debt Internal Sep 23, — Information about Form 1099C, Cancellation of Debt (Info Copy Only) Learn more Form 1099C IRS Courseware Link & Learn Taxes Lenders or creditors are required to issue Form

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Irs Schedule C 1040 Form Pdffiller

Mar 24, 21 · File Form 1099C for each debtor for whom you canceled $600 or more of a debt owed to you if You are an applicable financial entity An identifiable event has occurredClick Other Income in the Federal Quick Q&A Topics menu to expand, then click Cancellation of Debt (Form 1099C)Jun 07, 19 · You don't have to report anything on your tax return until you receive form 1099CAnd it depends on the lender when they will issue the form The debt is considered cancelled once your lender/creditor no longer expects for that money to come and they close their books It may be a couple years before they decide to foreclose and cancel your debt and issue you the 1099C form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

About Form 1099 C Cancellation Of Debt Plianced Inc

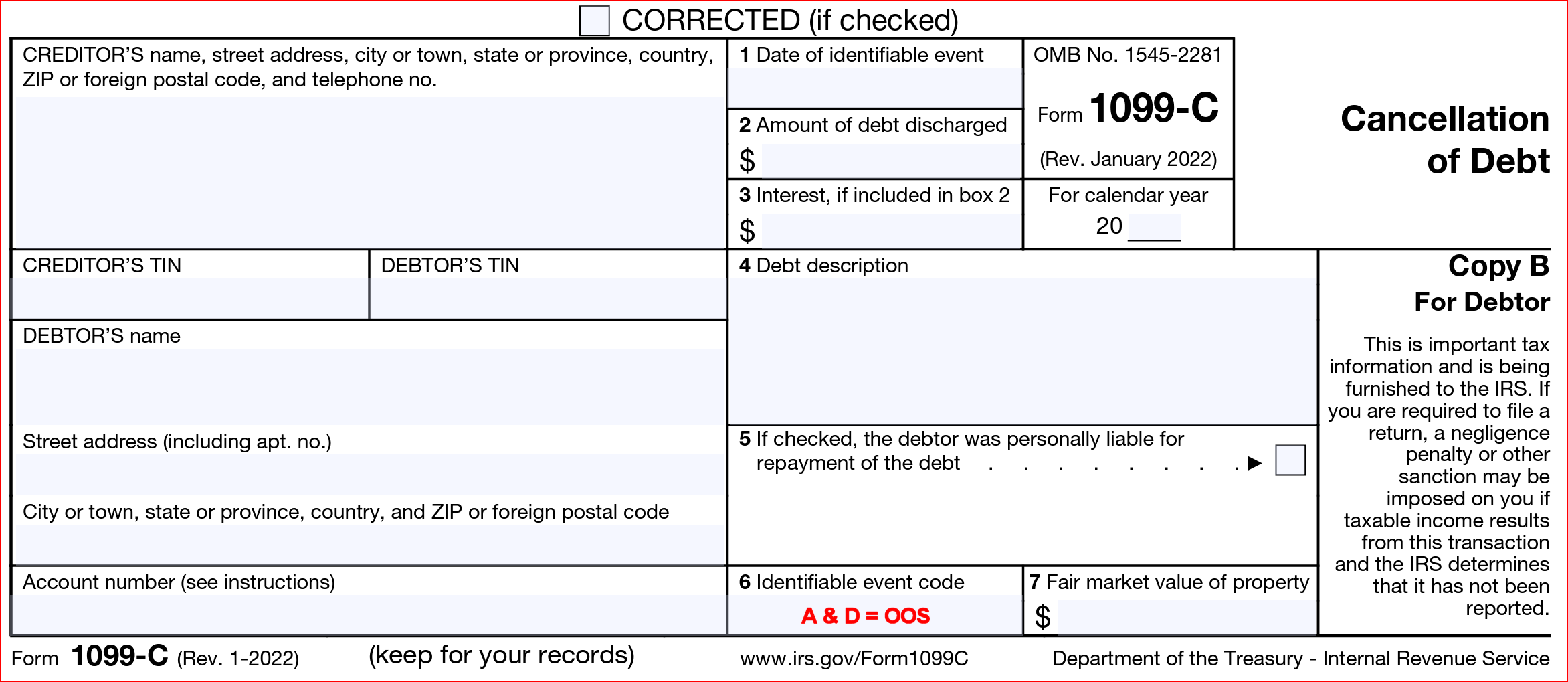

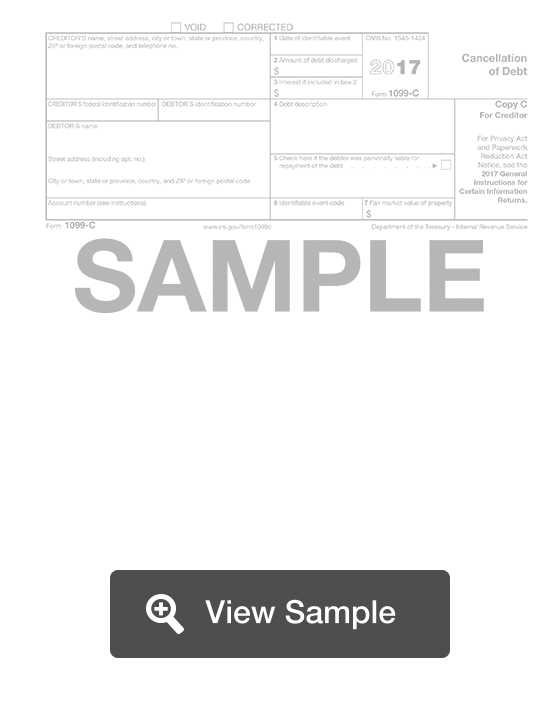

Form 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other 11/4/ PMForm 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you ifInst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21

Calameo Irs Instructions For 1099a C

Deadline For Forms 1099 Misc And 1099 Nec Is Feb 1 21 Cpa Practice Advisor

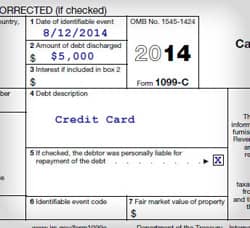

Feb 01, 21 · Form 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRSMar 09, 21 · I received a 1099C Cancellation of Debt formIt says that the date of the identifiable event was 12/23/, the amt of debt discharged was $, the debt description was "Consumer credit card", Box 5 said "Borrower was personally liable for repayment of debt, Box 6 shows Identifiable event code as "G" (Decision or policy to discontinue collection), State TN,Form 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

Apr 16, 09 · Ask for a corrected 1099C form New for the tax year Thanks to the federal government's Consolidated Appropriations Act, which was signed into law on Dec 27, , taxpayers who've had mortgage debt forgiven might not have to pay taxes on it when filling out their income taxes this year

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Instant Form 1099 Generator Create 1099 Easily Form Pros

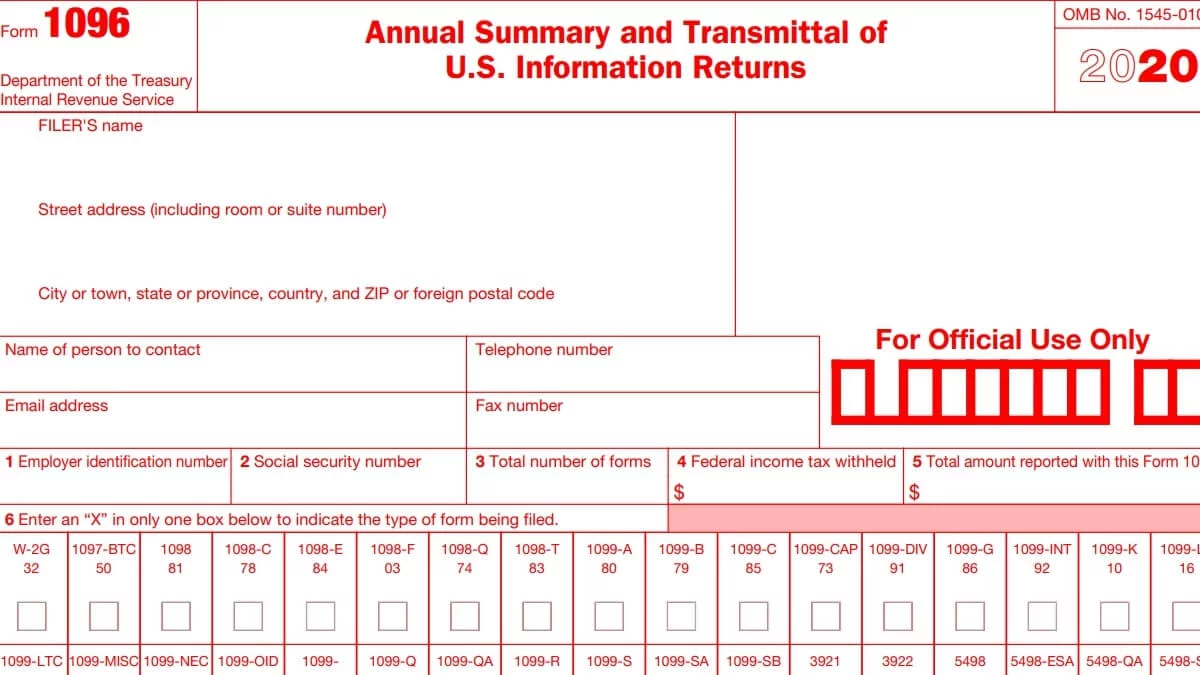

1096 Form 1099 Forms Taxuni

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

What Happens To Credit Card Debt During Bankruptcy Cardrates Com

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Index Of Forms

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Taxslayer 21 Tax Year Review Pcmag

1099 Nec Tax Forms Discount Tax Forms

1099 C Cancellation Of Debt H R Block

Form 1099 C Faqs About Liability For Cancelled Debts Formswift

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

1099 Misc Miscellaneous Income Payer Copy C 2up

What Is A 1099 C And What To Do About It

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

Irs Form 9 Is Your Friend If You Got A 1099 C

Continuous 1099 C 4 Part Carbonless Deluxe Com

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

I Just Got A 1099 C Form For A Debt From 16 Years Ago

1096 Form Irs Forms Zrivo

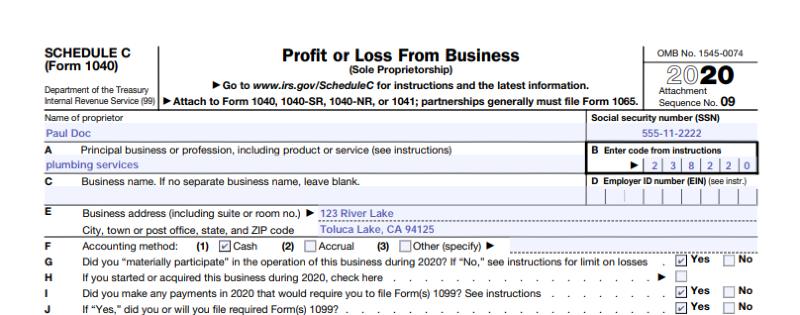

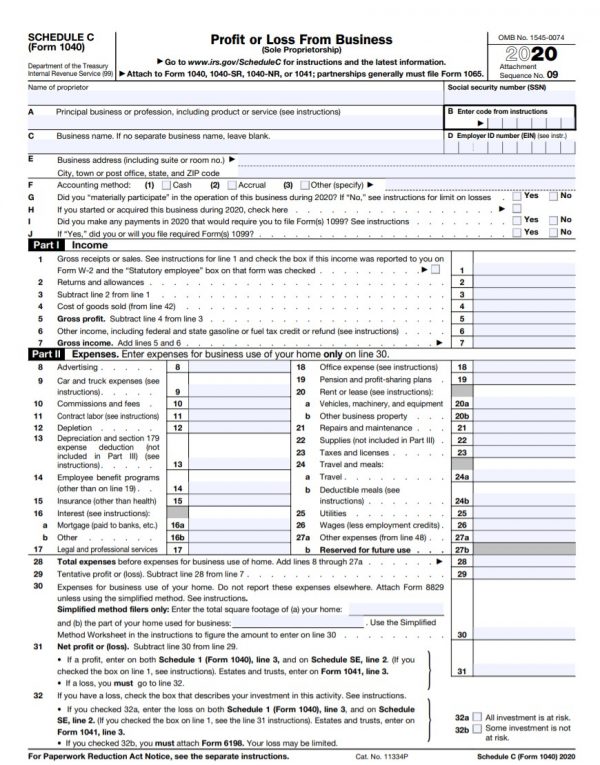

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Irs 1099 C Form Pdffiller

What Is A C Corporation What You Need To Know About C Corps Gusto

Horizon Software Firetax

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 C Cancellation Of Debt And Form 9

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Irs 1099 C Form Pdffiller

1099 Nec Form Copy C 2 Discount Tax Forms

How To File Schedule C Form 1040 Bench Accounting

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

When Is Canceled Debt Taxable Freedom Law Firm

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

Form 1099 Changes For Tax Year Lioness Magazine

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

:max_bytes(150000):strip_icc()/Screenshot97-2634390b2e984de3b6aecbab43ad252d.png)

Irs Form 1099 K What Is It

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

1099 C Software To Create Print E File Irs Form 1099 C

/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

The Timeshare Tax Trap 1099 C Questions Answered

How To Print And File Form 1099 C Youtube

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 C 18 Public Documents 1099 Pro Wiki

Irs Announces Form 1099 C Not Required For Ppp Loan Forgiveness Mcglinchey Stafford Pllc

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

1099 C Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Who Should Receive Form 1099 Misc

Form 99 C Archives Optima Tax Relief

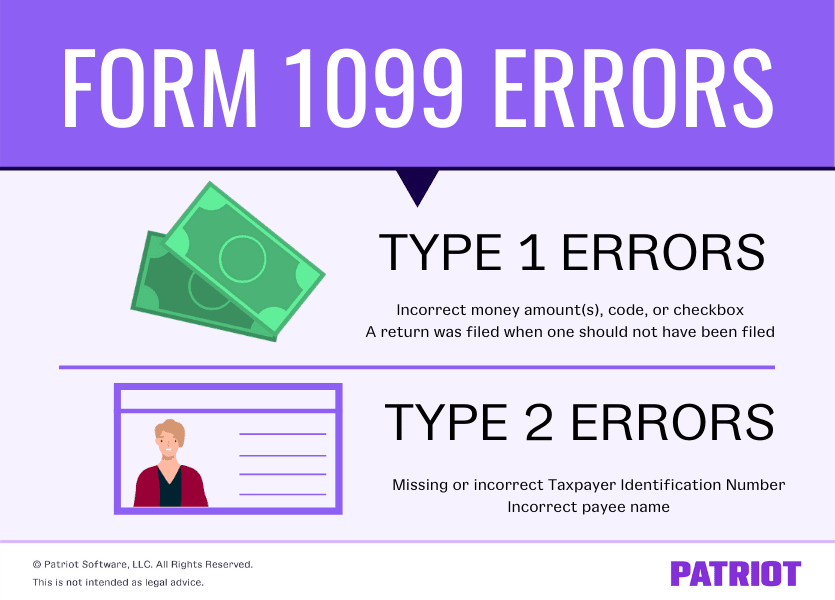

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About Form 1099

What Are Irs 1099 Forms

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

1099 C Cancellation Of Debt 4 Part 1 Wide Carbonless 0 Forms Pack

How A 1099 C Affects Your Taxes Innovative Tax Relief

Form 1099 Misc Miscellaneous Income Payer Copy C

Irs Form 1099 C Software 79 Print 2 Efile 1099 C Software

What Is Irs Schedule C Business Profit Loss Nerdwallet

New Form 1099 Reporting Requirements For Atkg Llp

1099 C What You Need To Know About This Irs Form The Motley Fool

Official 1099 Forms At Lower Prices Zbpforms Com

What Is An Irs Schedule C Form And What You Need To Know About It

Form 1099 Nec Nonemployee Compensation 1099nec

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller